什么是灰度的比特币钱包? 灰度的比特币钱包是一种数字货币管理工具,旨在为用户提供安全、简便、灵活的数字货...

Bitcoin is a decentralized digital currency, introduced in 2009 by an unknown person or group using the pseudonym Satoshi Nakamoto. It enables peer-to-peer transactions over the internet without the need for intermediaries, thus revolutionizing the way we think about money and transactions. To facilitate these transactions, users need a Bitcoin wallet.

A Bitcoin wallet is a software program or physical device that allows users to send, receive, and store their Bitcoin. The primary purpose of a wallet is to store the user's private keys, which are essential for authorizing transactions and managing their cryptocurrency holdings securely.

#### Types of Bitcoin WalletsHardware wallets are physical devices that store Bitcoin offline. The primary benefit of these wallets is their security, as they keep private keys away from internet-connected devices, minimizing the risk of hacking. Popular examples include Ledger Nano S and Trezor.

Software wallets are applications you can install on your computer or mobile device. They are easier to use than hardware wallets but come with security risks since they are connected to the internet. Examples include Exodus, Electrum, and Mycelium.

A paper wallet is a physical document that contains your public and private keys. It is considered one of the safest forms of storing Bitcoin, as it is offline and immune to online hacks. The downside is that if you lose the paper or it gets damaged, you lose access to your Bitcoins.

Mobile wallets are designed for smartphones, providing convenience for daily transactions. They are typically user-friendly and allow for fast payments. Examples include Trust Wallet and Coinbase Wallet, which also offer integrated exchange features.

Web wallets are accessible through a web browser, making them very convenient for users. However, they are more susceptible to attacks since they store your private keys on their servers. Examples include Blockchain.info and Coinbase.

#### How Bitcoin Wallets WorkAt the core of Bitcoin wallet technology are two types of cryptographic keys: public and private keys. A public key is akin to a bank account number, allowing others to send you Bitcoin. In contrast, a private key is like your PIN or password; it must be kept secret, as it grants access to your funds.

When you initiate a Bitcoin transaction, your wallet uses your private key to sign the transaction, confirming your ownership of the Bitcoin being sent. This transaction is then sent to the Bitcoin network where miners validate it and include it in the blockchain, completing the transfer.

#### Security in Bitcoin WalletsTo ensure the security of your Bitcoin wallet, it's essential to employ measures such as enabling two-factor authentication, regularly updating wallet software, and using strong, unique passwords. Hardware wallets are also recommended for long-term storage of substantial amounts of Bitcoin.

Common vulnerabilities include phishing attacks, malware, and loss of keys. To avoid these threats, be cautious of unsolicited communications, use antivirus software, and back up your wallet regularly. Educating yourself about security practices is crucial for cryptocurrency management.

#### Choosing the Right Bitcoin WalletWhen choosing a Bitcoin wallet, consider the following factors: security level, ease of use, accessibility, customer support, and additional features such as exchange capabilities or integration with other financial services.

Compare wallets based on their security features, transaction fees, and user reviews. For example, hardware wallets might offer superior security but come at a higher cost, while software wallets provide convenience at the risk of vulnerability.

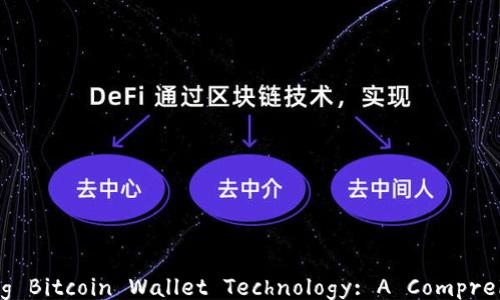

#### Future of Bitcoin Wallet TechnologyThe future of Bitcoin wallet technology likely involves more sophisticated security features, greater integration with decentralized finance (DeFi) applications, and enhanced user experiences. Technologies like multi-signature wallets and biometric authentication are becoming more prevalent.

Wallets are crucial in facilitating Bitcoin transactions and enabling mainstream adoption. As more people engage with Bitcoin, advancements in wallet technology will continue to play a pivotal role in the cryptocurrency ecosystem, promoting safer and more accessible financial transactions.

#### Frequently Asked QuestionsA hot wallet is connected to the internet, making it easy to access and use but more vulnerable to attacks. A cold wallet is offline, providing enhanced security but is less convenient for regular transactions.

If you lose access to your Bitcoin wallet without a backup of your private keys, you will lose access to your Bitcoin permanently. It's crucial to back up your keys and consider using recovery phrases provided by most wallets.

To keep your wallet secure, use hardware wallets for long-term storage, enable two-factor authentication, keep wallet software updated, and be cautious with your private keys. Regular backups also help mitigate the risk of losing access.

Most Bitcoin wallets are free to download and set up. However, you may incur transaction fees when sending Bitcoin, which varies based on network congestion and wallet choice. Some wallets may also charge withdrawal or exchange fees.

Yes, many users prefer to use multiple wallets for different purposes—some for daily transactions and others for long-term storage. This can help manage security risks and better organize funds.

In the event of a Bitcoin fork, users may receive an equivalent amount of the new cryptocurrency in their wallets. The impact of a fork is dependent on the wallet used and whether the wallet supports the new currency created by the fork.

This structure ensures that the topic is explored thoroughly, providing informative content suitable for both optimization and reader engagement. Each question is answered in a detailed manner, contributing to the overall word count and delivering significant value.