Outline:

I. Introduction to Cryptocurrency

- Definition and brief history of cryptocurrency

- Benefits and potential risks

II. Getting Started with Cryptocurrency

- How to buy and store cryptocurrencies

- Understanding cryptocurrency wallets

- Security measures

III. Popular Cryptocurrencies

- Overview of Bitcoin, Ethereum, and other major cryptocurrencies

- Differences between each cryptocurrency

IV. Cryptocurrency Trading

- Types of digital asset exchanges

- Tips on trading cryptocurrency

- Risks involved in trading

V. Legal and Regulatory Considerations

- Laws and regulations around cryptocurrency

- Best practices for compliance

VI. Future of Cryptocurrency

- Potential developments and trends

- Long-term outlook

Questions to be addressed:

1. What is cryptocurrency and why is it important in the world of finance?

2. How can someone start investing in cryptocurrencies?

3. What are the most popular cryptocurrencies and what makes them unique?

4. How can one start trading cryptocurrencies and what risks should they be aware of?

5. What is the legal and regulatory landscape surrounding cryptocurrency and how can one stay compliant?

6. What does the future hold for the cryptocurrency industry and what potential developments are on the horizon?

Answering Questions:

1. What is cryptocurrency and why is it important in the world of finance?

Cryptocurrency is a type of digital asset that uses encryption techniques to securely transfer value between individuals. Unlike traditional forms of currency, such as paper money or coins, cryptocurrencies are not issued or controlled by any central authority. Instead, they operate on a decentralized network that uses blockchain technology to record transactions. This makes cryptocurrency transactions fast, secure, and transparent.

In recent years, cryptocurrency has become increasingly important in the world of finance due to its potential to disrupt traditional financial systems. Cryptocurrencies offer faster and cheaper international transfers as compared to traditional methods that may require intermediaries and held up by central authorities. It also opens up new avenues of investments for individuals and institutions.

2. How can someone start investing in cryptocurrencies?

Investing in cryptocurrencies requires a few basic steps. First, an individual will need to set up a cryptocurrency wallet to store their digital assets. There are several types of wallets available, including hot wallets and cold wallets, each with its unique characteristics. Second, one can start buying cryptocurrencies on exchanges or through peer-to-peer networks. It's essential to research exchanges to ensure they are trustworthy and reputable. Finally, it's important to keep in mind that investing in cryptocurrencies carries risks and one should invest with caution.

3. What are the most popular cryptocurrencies and what makes them unique?

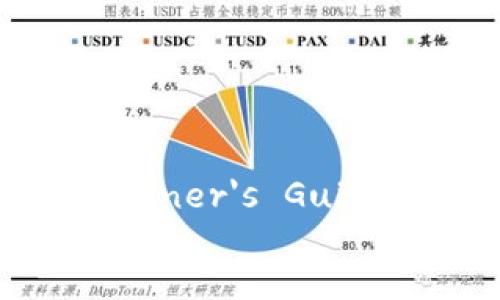

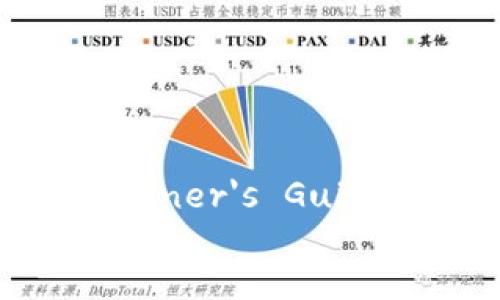

Bitcoin is undoubtedly the most popular cryptocurrency, with the largest market capitalization and dominance in the industry. Other popular cryptocurrencies include Ethereum, Ripple, Litecoin, and Bitcoin Cash. Each cryptocurrency has its unique features, including the underlying technology, mining process, and potential use cases. For instance, Ethereum is a public blockchain that is also an open-source platform for creating decentralized applications while Ripple is primarily focused on powering cross-border payments.

4. How can one start trading cryptocurrencies and what risks should they be aware of?

To start trading cryptocurrencies, one must first register with a reputable cryptocurrency exchange. After verifying their identity, they can deposit funds and start buying and selling cryptocurrencies. Some popular exchanges include Binance, Coinbase, and Kraken. It's essential to research the exchange's security features and fees to find a suitable platform.

It's essential to be aware of the risks involved when trading cryptocurrencies. The market is notoriously volatile, and prices fluctuate rapidly within short periods. While this can generate significant profits, it can also result in substantial losses. Additionally, the lack of regulatory oversight means there is an increased risk of scams and fraud.

5. What is the legal and regulatory landscape surrounding cryptocurrency and how can one stay compliant?

The legality of cryptocurrency varies from country to country, and some governments have banned cryptocurrency altogether. In other countries, cryptocurrency is regulated, with laws in place to protect consumers. In the United States, for example, the IRS has classified cryptocurrency as property for tax purposes.

To stay compliant, individuals and businesses must keep records of their cryptocurrency transactions and report them accurately to the relevant authorities. It's essential to research the legal and regulatory landscape in your jurisdiction before investing in or trading cryptocurrency.

6. What does the future hold for the cryptocurrency industry, and what potential developments are on the horizon?

The future of the cryptocurrency industry remains uncertain, but some trends and developments are likely to shape the landscape. One of the most significant developments is Central Bank Digital Currencies (CBDCs), which are cryptocurrencies issued by governments. This could potentially increase the adoption of cryptocurrency and blockchain technology in traditional finance.

Other potential developments include increased use of blockchain technology in industries such as supply chain and logistics, tokenization of assets, and increased regulatory oversight and compliance measures. Overall, the cryptocurrency industry is continually evolving, and it's essential to keep up with the latest trends and developments.

tpwallet

TokenPocket是全球最大的数字货币钱包,支持包括BTC, ETH, BSC, TRON, Aptos, Polygon, Solana, OKExChain, Polkadot, Kusama, EOS等在内的所有主流公链及Layer 2,已为全球近千万用户提供可信赖的数字货币资产管理服务,也是当前DeFi用户必备的工具钱包。

Investing in cryptocurrencies requires a few basic steps. First, an individual will need to set up a cryptocurrency wallet to store their digital assets. There are several types of wallets available, including hot wallets and cold wallets, each with its unique characteristics. Second, one can start buying cryptocurrencies on exchanges or through peer-to-peer networks. It's essential to research exchanges to ensure they are trustworthy and reputable. Finally, it's important to keep in mind that investing in cryptocurrencies carries risks and one should invest with caution.

Investing in cryptocurrencies requires a few basic steps. First, an individual will need to set up a cryptocurrency wallet to store their digital assets. There are several types of wallets available, including hot wallets and cold wallets, each with its unique characteristics. Second, one can start buying cryptocurrencies on exchanges or through peer-to-peer networks. It's essential to research exchanges to ensure they are trustworthy and reputable. Finally, it's important to keep in mind that investing in cryptocurrencies carries risks and one should invest with caution.

To start trading cryptocurrencies, one must first register with a reputable cryptocurrency exchange. After verifying their identity, they can deposit funds and start buying and selling cryptocurrencies. Some popular exchanges include Binance, Coinbase, and Kraken. It's essential to research the exchange's security features and fees to find a suitable platform.

It's essential to be aware of the risks involved when trading cryptocurrencies. The market is notoriously volatile, and prices fluctuate rapidly within short periods. While this can generate significant profits, it can also result in substantial losses. Additionally, the lack of regulatory oversight means there is an increased risk of scams and fraud.

To start trading cryptocurrencies, one must first register with a reputable cryptocurrency exchange. After verifying their identity, they can deposit funds and start buying and selling cryptocurrencies. Some popular exchanges include Binance, Coinbase, and Kraken. It's essential to research the exchange's security features and fees to find a suitable platform.

It's essential to be aware of the risks involved when trading cryptocurrencies. The market is notoriously volatile, and prices fluctuate rapidly within short periods. While this can generate significant profits, it can also result in substantial losses. Additionally, the lack of regulatory oversight means there is an increased risk of scams and fraud.